Tom Hoge: Profil dan Perjalanan Karier Profesional Golf

Pendahuluan Tom Hoge: Profil dan Perjalanan Karier Profesional Golf. Tom Hoge adalah seorang pegolf profesional…

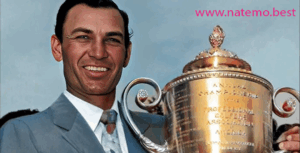

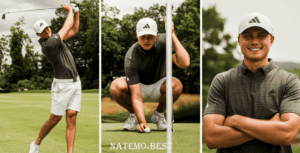

Aldrich Potgieter Membuat Sejarah PGA Tour pada Usia 20 Tahun dengan Menang di Rocket Classic

Pendahuluan Aldrich Potgieter Pada usia yang masih sangat muda, Aldrich Potgieter berhasil mencuri perhatian dunia…

Wali Kota Pontianak Edi Rusdi Kamtono Menjajal Lapangan Golf First Wing Golf

Pendahuluan Wali Kota Pontianak, Edi Rusdi Kamtono, menghadiri acara peresmian lapangan golf terbaru di kota…

Membangun Fasilitas Pendidikan Lewat Turnamen Golf: Harmoni Olahraga dan Aksi Sosial

Pendahuluan Membangun Fasilitas Pendidikan Dalam era modern ini, olahraga telah menjadi sarana yang efektif tidak…

Kisah Inspiratif Atthaya Thitikul: Sang Golf Ace yang Berhasil Mengukir Sejarah di Panggung Dunia

Pendahuluan Kisah Inspiratif Atthaya Thitikul Dalam dunia olahraga golf, nama Atthaya Thitikul telah menjadi simbol…

Atthaya Thitikul Mengukir Prestasi Gemilang di Babak Final BMW Ladies Championship di Oak Valley Country Club

Pendahuluan Atthaya Thitikul Pada hari terakhir turnamen golf bergengsi BMW Ladies Championship yang digelar di…

Cheyenne Woods Raih Kemenangan di Volvik RACV Wanita Master dan Bawa Puluhan Ribu Dolar

Pendahuluan Cheyenne Woods Dalam dunia golf profesional wanita, setiap turnamen menjadi ajang pembuktian kemampuan pemain…

Danny Masrin: Atlet Golf Berbakat yang Telah Malang Melintang di Dunia Olahraga

Pendahuluan Danny Masrin Dalam dunia olahraga golf Indonesia, nama Danny Masrin sudah tidak asing lagi.…

Charley Hull: Bintang Muda Golf Inggris yang Pernah Menjadi Pendatang Baru Terbaik

Pendahuluan Charley Hull adalah salah satu pegolf muda berbakat asal Inggris yang telah menarik perhatian…

Tatiana Wijaya: Atlet Golf Wanita Indonesia yang Berprestasi di Kompetisi Simone Asia Pacific

Pendahuluan Tatiana Wijaya adalah salah satu atlet golf wanita Indonesia yang tengah menunjukkan prestasi luar…