Seon Woo Bae: Perjalanan dan Prestasi Gemilang dari Yonsei University

Pendahuluan Seon Woo Bae adalah salah satu nama yang semakin bersinar di dunia golf profesional…

Kisah Perjuangan Alvi Novita: Atlet Golf Wanita Satu-Satunya di Jawa Timur

Pendahuluan Kisah Perjuangan Alvi Novita Dalam dunia olahraga, kisah perjuangan dan dedikasi para atlet seringkali…

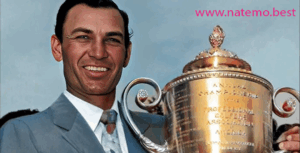

Jack Nicklaus: Legenda Golf yang Meraih Rekor Terbanyak dalam Koleksi Gelar Utama

Pendahuluan Jack Nicklaus Dalam dunia golf, nama Jack Nicklaus dikenal sebagai salah satu ikon terbesar…

Pancarkan Pesona ‘Idol Atlet’: Minho SHINee Bergabung dalam Acara TV ‘Golf King’ Musim Kedua

Pendahuluan Pancarkan Pesona 'Idol Atlet Dalam dunia hiburan Korea Selatan, kombinasi antara bakat seni dan…

Format Permainan Golf: Memasukkan Bola Kecil Berwarna Putih ke Lubang di Golf Course

Pendahuluan Format Permainan Golf adalah salah satu olahraga rekreasi dan kompetitif yang populer di seluruh…

Mencoba Simulasi Bermain Gold Menggunakan Produk Terbaru dari BenQ: Pengalaman dan Review

Pendahuluan Mencoba Simulasi Bermain Gold Dalam era digital saat ini, permainan video semakin populer di…

Turnamen Golf dengan Misi Sosial: Mendukung Pembangunan Fasilitas Pendidikan yang Layak

Pendahuluan Turnamen Golf dengan Misi Sosial Dalam era yang semakin peduli terhadap kesejahteraan masyarakat dan…

Tom Hoge: Profil dan Perjalanan Karier Profesional Golf

Pendahuluan Tom Hoge: Profil dan Perjalanan Karier Profesional Golf. Tom Hoge adalah seorang pegolf profesional…

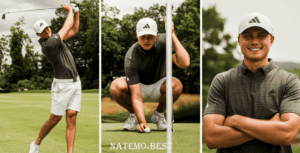

Aldrich Potgieter Membuat Sejarah PGA Tour pada Usia 20 Tahun dengan Menang di Rocket Classic

Pendahuluan Aldrich Potgieter Pada usia yang masih sangat muda, Aldrich Potgieter berhasil mencuri perhatian dunia…

Wali Kota Pontianak Edi Rusdi Kamtono Menjajal Lapangan Golf First Wing Golf

Pendahuluan Wali Kota Pontianak, Edi Rusdi Kamtono, menghadiri acara peresmian lapangan golf terbaru di kota…